When third-party vendor grow, it’s become critical to manage vendor risk management process. As we know that vendors have access to consumer data, hence your company must control their cybersecurity risk to avoid problems in the future. Using a risk-based approach to vendor management requires an organization to have a complete understanding of the various types of vendor risk. This knowledge helps organizations to measure third-party risk and identify vendors.

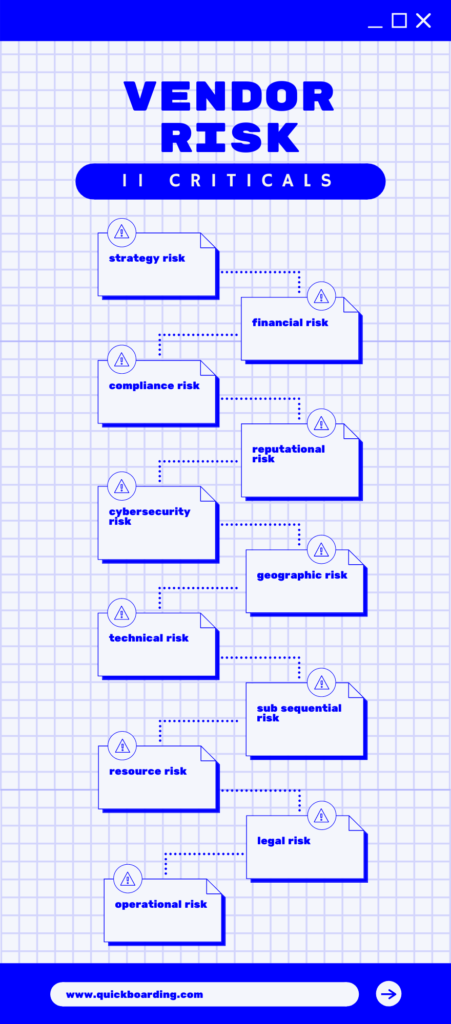

Types of Risk Coverage

Strategy Risk

It is the risk which arises by poor management or by the failure to execute correct business decision in terms with the organization’s strategic goal.

Financial Risk

It is the risk that arises when a third party or any other borrower unable to fulfill the terms and conditions required for the third party agreement. The financial risk also referred as credit risk.

Compliance Risk

It is also known as regulatory risk arises when there is a violation of laws, rules, and regulations with internal policies and procedures. The risk occurs whenever the product or activities of a third party doesn’t support the rules, regulations, policies, or ethical standards.

Geographic Risk

It is the location of your vendors who are affecting your business. Dealing with suppliers from other countries following all the important rules and regulations comes under geographic risk. For example, General Data Protection Regulation (GDPR) privacy and data protection have become a major source of concern for those doing business with European companies.

Technical Risk

This is the changes that could be done on the project, system, or entire infrastructure when an implementation doesn’t work well.

Sub-sequential Risk

This is the risk that arises when your customer uses a third party for any of their processes as it may affect your company as well. Because by using any third party there might be chances that the documents and information present will be misused.

Resource Risk

This is the risk where there may be chances that you will fail to achieve the goal assigned to you due to a lack of resources. Where the resources can be anything like finance, time, skilled workers, etc which is required to achieve a particular goal.

Legal Risk

This occurs when a condition precedent is not met or a specified deadline is skipped, situations become impossible to manage, and as a result, we begin completing tasks quickly. As a result, the risk is increased, and this risk is often referred to as legal risk.

Operational Risk

This occurs when the vendor processes are about to end. Here, the third-party operations are performed in such a way that it becomes difficult for vendors to provide their services on the other hand organizations are unable to perform daily activities.

Reputational Risk

This arises from the negative view or opinion of the public towards your company. It is the image of the company that is been ruined in the minds of the public, investors, customers, media, etc. The reputation is harmed when the customers are not satisfied, violations of rules and regulations, customer complaints, etc.

Cybersecurity Risk

This includes hacking of data, ransomware, and other types of cyber disasters which are become very popular. All businesses are at risk, including major financial institutions, banks, healthcare providers, credit unions, electricity generating facilities, suppliers, and retailers. This risk comes under cybersecurity risk.

Also Read: Transforming Vendor Onboarding Process: Tips, Approach and Strategies

Why you need to manager Vendor risk?

As we have discussed above that there are different types of risk in vendor onboarding which somewhere harm your company. As a result, it is important to have a process of vendor risk management. No matter how effective the internal security policies are, if the third-party suppliers have bad security standards, they will pose a significant risk. One way to reduce the risk is to give the vendor access to only those data which they are required instead of giving them access to the whole data.

51% of surveyed companies stated that collecting risk information on third parties is manual and time consuming

Source: Security Boulevard

Benefits of Vendor Risk Management

Everything has its benefit so as vendor risk management also let’s take a look over some of them

- Improvement in the availability of resources.

- As long as plans are followed risks are reduced.

- Decrement in the cost.

- When the future risks are already known it takes less time and fewer resources.

- Services qualities remain safe.

Conclusion

This article has told us about the different types of critical risks in vendor onboarding, as well as the significance of handling vendor risks and the benefits of vendor risk management. We concluded that various types of risk impact our business, whether it is strategy risk, financial risk, compliance risk, cybersecurity risk, technical risk, and so on, and it has become critical to handle all types of risk.

About Quickboarding

Quickboarding on/off-boarding resolution is the best suit for vendor onboarding automation. Its receptive use and self conjugation platform help Banks, HR, and Insurance firms in automating completely different reasonably on/off-boarding use cases. Contact the North American nation if you would like to envision and skill a digital transformation in your business.