We all know that “one size does not fit all,” and onboarding is no exception. It is self-evident that a one-size-fits-all solution is ineffective. The onboarding process for a simple retailer differs from the process for an institutional banking system, as well as the process for a commercial retailer. Customer onboarding has never been a simple and easy process from a company standpoint. It requires a lot of documentation and a variety of other processes and on the other hand, the bank still keeps the application under review. Since the whole procedure takes a long time to complete, regular customer onboarding has become a stressful experience.

It’s a well-known reality that many banks and businesses have experienced problems as a result of COVID 19, due to which things are beginning to shift in digital form, including the onboarding process as well. The method of digital customer onboarding has been implemented for the convenience of customers.

Before moving inside the future of customer onboarding, digital customer onboarding process, KPIs, etc. Let’s take a look at the current state of customer onboarding and the issues with it.

What is Customer Onboarding?

Customer onboarding is the process of introducing a new customer to the company’s products and services, as well as showing them how to get the most out of them. Onboarding new customers involve listening to their questions and solving their doubts related to your services. It’s all about making their experience as smooth and fast as possible. Hence, customer onboarding refers to the process where you tell your customers all the services you are offering. The goal of onboarding is to get the customer on board. It’s not just providing all the information the customer needs to understand your product; it’s about knowing them and their needs.

Benefits of Customer Onboarding

- Your customers will come back again and again.

- Your customers will tell about you to their friends and family.

- Reduce the amount of time it takes to value and so on.

Also Read: Time to analyze your Loan onboarding process – 5 Metrics and KPIs to Look for

Traditional onboarding is prone to errors, time taking, and involved too much paperwork. From loan application to loan approval, this process may take up to eight weeks. However thanks to digitalization, it just takes a few clicks and you’ll approve for a loan in a matter of minutes. The need for digital transformation is urgent, and it will undoubtedly reduce human error and costs.

Issues with current Customer Onboarding Process

Unavailability of a Structured Method

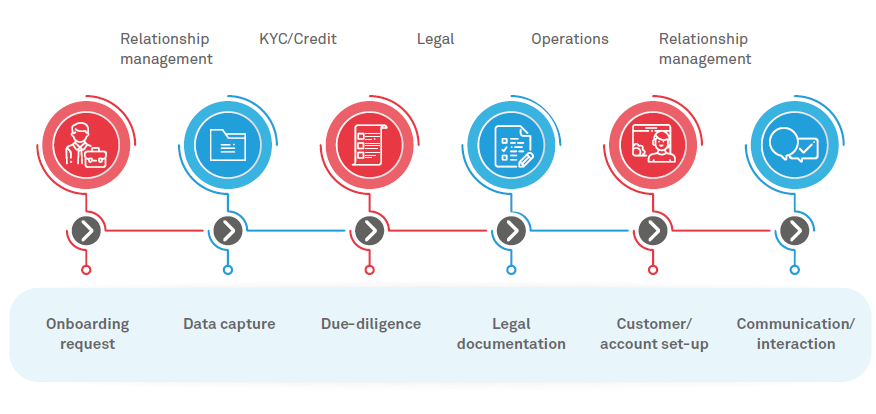

Customer onboarding follows a number of the process including legal, credit, and operational. But one thing to keep in mind is that each process has its own rules and regulations and way to perform them. Hence the different results in each process may vary in every bank in one form to another which leads to a long and lengthy process.

Changing Regulations

Talking about the current scenario regulations do not change yearly sometimes it changes monthly and sometimes weekly. As result banks need to keep update their procedures as per the fresh guidelines. It leads to a big challenge for banks, as they must not only justify the changes to clients but also ensure that they are updated during the onboarding process. Due to several changes bank needs to revisit the process again and again so that they don’t miss anything.

Access

With the advancement of digital technology, the demand for banks to provide services in real-time is increasing. People nowadays want everything to be digitalized so that they can stop going to locations. In the case of banks, people want the whole banking system on their mobile phones so that they can keep track of things easily. On the other hand, some banks continue to use the old conventional system, which makes delivering online services to their customers a difficult task for them.

Time consuming process

Since a large number of documents are needed in the loaning process, collecting all of the data and documents is often a time-consuming process. Let’s use an example to better understand this; a bank is made up of three different businesses – corporate, banking and insurance which provides to a different form of company. Imagine if your customer becomes the customer of all three banks that means they need to complete the whole procedure three times. That’s time-consuming!!!

The traditional method requires an excessive amount of time, effort and is very much dreary. These unyielding natures of the traditional process are making organizations shift towards digital space as it is an easier and simpler process. Traditional processes consist of any kind of process such as verification of customer identity, online verification of identity, digital id verification, automated id verification, KYC digital verification, etc.

Necessity of Digital Customer Onboarding in COVID 19

This year COVID 19 has changed the perception of many traditional lenders too and now they are convinced that digital customer onboarding is the way forward to grow quickly.

As we all know throughout the time of COVID 19 several banks are unable to provide the loan to individuals as there’s no solution exists at that moment under that they’ll give the loan to individuals. During this lending risk analysis plays a major role. As in risk analysis if we are not able to identify the risk of a person then we will not give the lend to that person.

In simple words, we can say that if we are giving money to a person and they aren’t able to return that money to use in the first time and in the second time too. Then it’s petty obvious that for the third time we will also not give money to that person as there’ll be a risk involved in it.

The same thing happens in banks also that is there are certain parameters exist which is needed to be fulfilled to give loan to individuals and during the time of COVID 19 that parameters are not fulfilled as a result banks are not able to give loan to individuals. That’s why digital customer onboarding has become important.

Future of Customer Onboarding

To overcome all the above challenges banks are turning to new technology to increase their performance. It not only reduces their workload but also makes the process simple for their customers. As we move closer to open banking, client onboarding can take the form of the following methods in the future.

Artificial Intelligence

This technology made real-time video identification possible that helps in KYC (Know Your Customer) process. It has proved to bring revolution to corporations in the financial sector. As a result, companies that use this technology have seen a significant increase in their client acquisition conversion rates. The technology conjointly complies with the strictest video identification security standards thus protecting clients against fraud.

Blockchain

This technology helps especially in the KYC process as it helps the user to manage their digital identity with high-grade security. Not only has this it also helped institutions and businesses to manage their data with reliability and ease.

Some banks in other countries are already using blockchain to secure their and customers’ data.

Further Read: OCBC Bank, HSBC and MUFG in KYC blockchain breakthrough

Biometrics

This technology is used to identify a person’s inborn characteristics. It is based on their personality or physical appearances, such as face recognition, fingerprint identification, iris detection, voice recognition, and other things. Some of the larger banks, such as OCBS, Maybank, are already implementing this technology to simplify their banking processes and make it an easy one for the use of their customers.

Conclusion

The digital onboarding process is ton relaxed as compared to the traditional onboarding process. There are many ways to implement new technologies and together we can do this. This transformation journey of years can be greatly shortened with new upcoming technologies such as blockchain, artificial intelligence, machine learning (ML), etc. As the world is now moving in the digital age or the age of digitalization the processes are becoming fast and quick. In this digitalization, the onboarding process is also changing very fast and in an efficient manner. The future is no doubt the digital onboarding of customers because of its so many advantages and fewer loopholes.

About Quickboarding

Quickboarding on/off-boarding resolution is the best suit for onboarding automation. Its receptive use and self conjugation platform help Banks, HR Firms, property, and Insurance firms in automating completely different reasonably on/off-boarding use cases. Contact the North American nation if you would like to envision and skill a digital transformation in your business.