The shifts brought on by technology have prompted several companies to undergo a digital transition. By digitization, companies are able to streamline operations and take action to find new opportunities.

One thing that has improved in the customer success sector is digital client onboarding.

After March 2020, several markets have undergone dramatic shift owing to the COVID-19 pandemic. Wide companies have begun recognizing the remarkable promise of digitization. Financial companies are increasingly implementing advanced steps and a greater emphasis on their online footprint to fulfill the demands of consumers when they migrate digitally. With all of this, automated consumer onboarding has been very common now in the all industries.

What is Digital Client Onboarding?

Digital client onboarding is an online mechanism allowing potential consumers to access all resources and goods delivered by an institution easily and conveniently. Onboarding is the first glimpse of help and the relationship that consumers may receive from a company, making it important for businesses to make a good early impression.

Why Digital Client Onboarding?

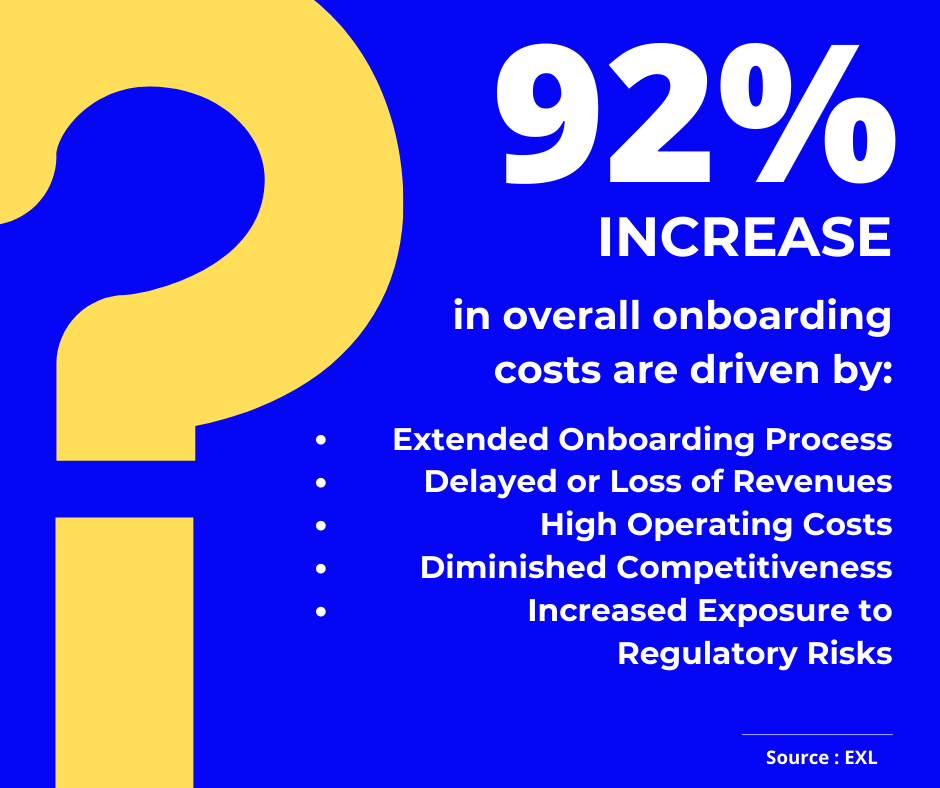

Many businesses lose their potential customer at an early stage due to an inadequate on-boarding method. This is the first step in the relationship between the consumer and the business. What if the digital client onboarding procedure is time-consuming and time-consuming? Do you think the customer would want to continue? Of course, not.

The most vital aspect of good client onboarding is the opportunity to improve and maintain up with the clients’ satisfaction. Many of these items make it impossible for consumers to do business with a financial company, risking reputational harm and lack of future sales. A streamlined onboarding procedure has to be versatile enough to accommodate the regulatory and customer needs.

How to Adopt Digital Client Onboarding?

Understanding Gaps

Completing a current state review is the first step to automating customer on-boarding procedures. Companies first have to identify the current challenges in the onboarding process, which steps take the most time, which steps cost most investment of both time and money. This activity will help the institution to choose the best digital adoption technique to resolve their onboarding bottlenecks.

Identify Targets

Once the onboarding pain points are identified now it’s time to automate these processes based on complexity. Priority measurement can be done by queuing the current challenges based upon their complexity. When complexities are categorized into low, medium and high category it will become easier for companies to fill up those gaps.

Choosing Technology Partner

After identifying the current state and challenges it is now time to choose the correct technology partners who can help converting your plans into reality. It’s important to choose a reliable technology partner. When selecting a vendor, institutions can recognize not just expense and cognitive functionality, but also continuing vendor support, vendor expertise, and growth (i.e. what technology should be implemented, how – and by whom – can the technology be maintained, and who will be liable for implementation of any new capabilities?.).

Completing Dry Runs

Once the technology partner is finalized, now it’s important to start with automating moderate complexity gaps. Dry runs involves unit and functional testing helping institutions to understand how the things will be work in live environment. After applying automated technologies in a regulated environment over a limited period of time, businesses can clearly grasp the outcomes that they can realistically hope to see, and can accordingly extend the next step of the project.

GO Live

After successfully completing the dry runs, institutions can begin with full process automation in phased manner.

Maintaining & Scaling Up

In this stage the deployed automated onboarding mechanism will be monitored for understanding the key areas of further improvements.

Conclusion

Companies are spending much time and money to reach and onboard their potential customers. Digital technologies like Risk Analysis, Machine Learning and Automated document collection and analysis can help all type of institutions in saving both time and money alongside improving the first hand experience for their customers.

Adoption of Digital technology or digital onboarding platform helps companies in many ways like saving manual efforts, reducing chances of error and analyzing the gaps in customer servicing in most easy and convenient with the help of customer data.

Quickboarding on/off boarding solution is best suit for onboarding automation. It’s open to use and self servicing platform helps Banks, HR Firms, Real estate and Insurance Companies in automating different kind of on/off boarding use cases. Contact Us if you want to see and experience a digital transformation in your business.